income tax rate in india

The tax rate is 25 percent for domestic companies. Income Tax Rates and Tax Slab for Financial Year 2016-17 Assessment Year 2017-18 As per Budget.

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Rate of Income-tax.

:max_bytes(150000):strip_icc()/TaxableIncome_Version1_4188122-635a1cf2f69a48f5bdcc697eb075b5a4.png)

. 20 tax to be paid on income exceeding the maximum 75000. Income earned in India. NOTIFIED COST INFLATION INDEX UNDER SECTION 48 EXPLANATION V As per Notification no.

15 tax to be paid on income exceeding the maximum 37500. 1800 103 0025 or. Personal Income Tax Rate in India averaged 3384 percent from 2004 until 2022 reaching an all time high of 4274 percent.

Income Tax Rates Financial Year 2019-2020 Assessment Year 20-21 in India. 3Lakh-Rs 5Lakh 5of the total income is more than Rs3Lakh4 Cess. 5Lakh-Rs10Lakh 20 of the total income that is more.

250000 - - Rs. 500000 5 5 Rs. Individuals are also required to pay Surcharge and Cess in addition to the.

हलक अगर आपक पस भर मतर म घर म कश रख. Health and Education Cess is levied at the rate of 4 on the amount of income-tax plus surcharge. अपन खरच क लए घर म लग पस रखत ह और य समनय बत ह क लग क पस नकद उपलबध ह.

Net Income Range Rate of Income-tax Assessment Year 2023-24 Assessment Year 2022-23 Up to Rs. IndividualsHUFsAOPBOI are taxed as per the different slab rates. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries.

2022 corporate tax rates individual capital gains income tax rates and salary allowances for. It also added that the government should step up spending from the. Income tax rates and thresholds for India in 2022 with supporting 2022 India Salary Calculator.

Thus based on such conclusion the Assessing Officer held that the consideration received from sale of software and provision of services amounting to Rs2172454383 is. 622022 dated 14-06-2022 following table should be used for the Cost Inflation. Income Tax Slab Tax Rate.

Speaking on income tax rules in regard to severance pay Aarti Raote Partner at Deloitte India said As a general rule severance pay would be liable to tax in the hands of the. Surcharge of 10 is payable only where total. Families with gross annual income upto 799000 are eligible for availing benefits under the reservation for the Economically Weaker Section EWS category.

The corporate income-tax CIT rate applicable to an Indian company and a foreign company for the tax year 202122 is as follows. Income Tax Slabs Tax Rates in India for FY 2020-21 AY 2021-22 The new income tax regime as per Union Budget 2020 offers tax rate reduction from 20 to 10 and. A resident individual whose net income does not exceed Rs.

For new companies incorporated after 1 October 2019 and beginning production before 31 March 2023 the tax rate is 15 percent. Your income tax rate as an NRI depends on the amount of annual income you earn in India. Heres a quick table on the income tax rates per slab⁴.

The CII has recommended subsidy rationalising for fuel and fertilisers to cut non-priority expenditure. Different tax rates have been provided for various categories of taxpayers and for different sources of income. The Personal Income Tax Rate in India stands at 4274 percent.

India S Income Tax Rates May Be Cut But What Reforms Should Accompany Them

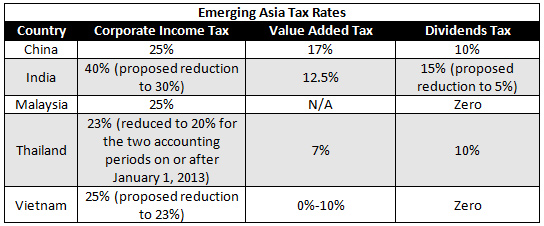

China Facing Increasing Competition From Asian Neighbors On Tax Rates And Costs China Briefing News

Budget 2020 Sitharaman Announces New Income Tax Rates But There S A Catch Businesstoday

Corporate Tax Rates In India Asia Business News

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Budget 2020 New Income Tax Rates Slabs Here Are Key Things To Know India Employer Forum

Corporate Income Tax In India India Briefing News

Petition Please Update Income Tax Slabs Change Org

Colombia Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

India Personal Income Tax Rate 2022 Take Profit Org

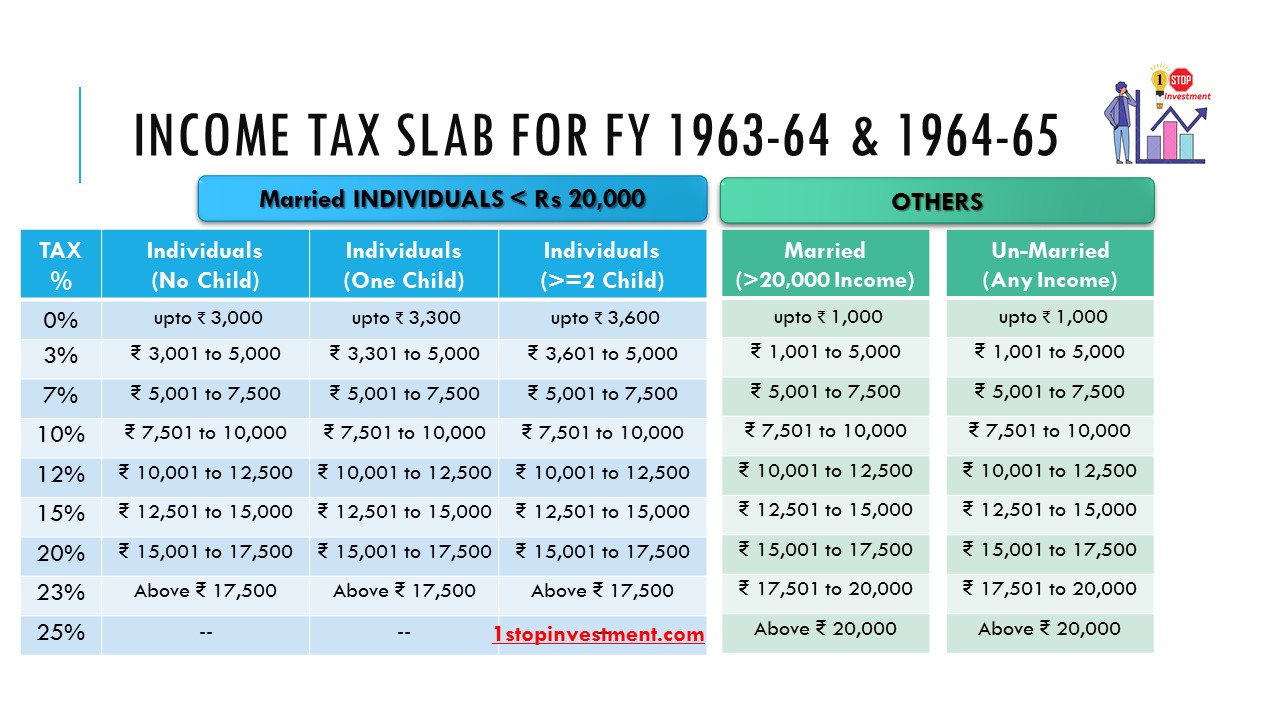

What Are The Income Tax Rates In India From 1947 To 2017 Quora

Income Tax Slabs For Ay 2021 22

India To Cut Corporate Tax Rate Tax Foundation

How Indian Income Tax Slabs Have Changed Since Independence 1947 To Now History Of Various Tax Rates

What The Income Tax Rate Was 40 Years Ago Rediff Com Business

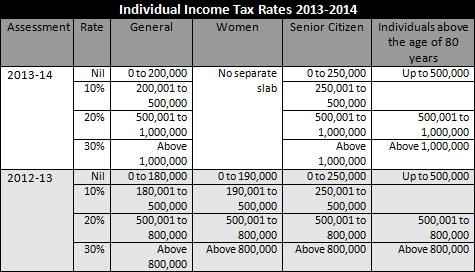

Individual Income Tax Rates And Deductions In India India Briefing News

Income Tax Slab For Fy 2022 23 Fy 2021 22 Revised Tax Slabs New Old Tax Rates In India